Buy My House: Mortgage Pre-Approval Checklist & Current Rates in New York sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

This guide will walk you through the essential steps of mortgage pre-approval, current rates in New York, financial preparation tips, and working with lenders and real estate agents, providing you with a comprehensive overview of the home buying process.

Mortgage Pre-Approval Process

Obtaining a mortgage pre-approval is a crucial step in the home buying process as it gives you a clear picture of how much you can afford to borrow. It also shows sellers that you are a serious buyer, which can give you an edge in a competitive market.

Steps involved in obtaining a mortgage pre-approval

- Complete a mortgage pre-approval application with a lender.

- Provide necessary documentation such as income verification, employment history, credit score, and assets.

- Lender evaluates your financial information and determines the maximum loan amount you qualify for.

- Receive a pre-approval letter stating the loan amount you are approved for.

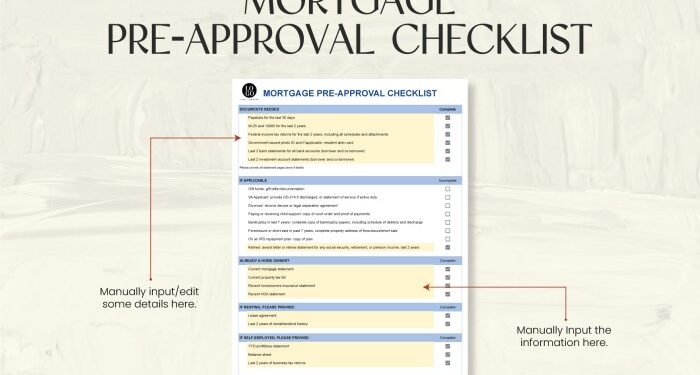

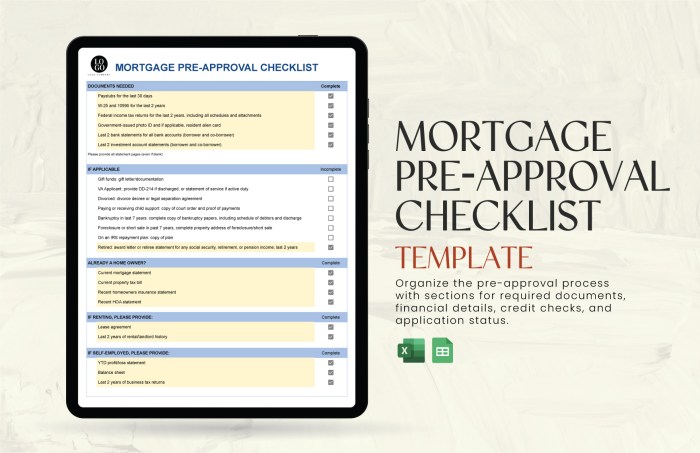

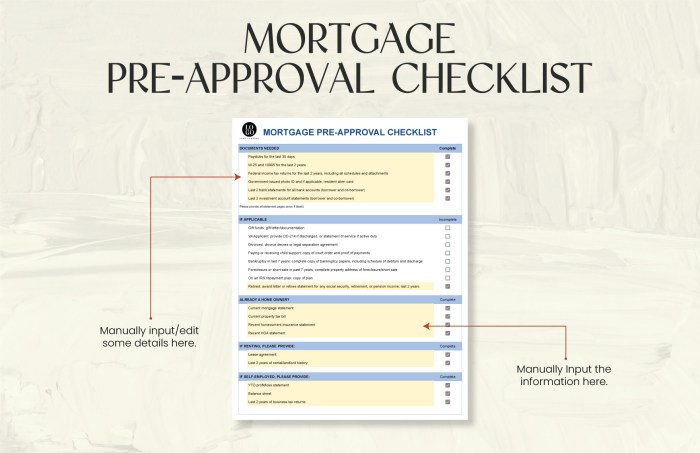

Documents required for a mortgage pre-approval

- Proof of income (pay stubs, W-2s, tax returns).

- Employment verification.

- Proof of assets (bank statements, investment accounts).

- Identification (driver's license, passport).

- Credit history and score.

Importance of getting pre-approved before house hunting

Getting pre-approved before house hunting can save you time and disappointment. It helps you narrow down your search to homes you can afford and gives you an advantage when making an offer. Sellers are more likely to take you seriously if you have a pre-approval letter, and it can help streamline the closing process once your offer is accepted.

Current Mortgage Rates in New York

When it comes to purchasing a home in New York, understanding the current mortgage rates is crucial. Mortgage rates can greatly impact your monthly payments and overall affordability. Let's take a look at the current landscape of mortgage rates in New York and how they can influence your home buying decision.

Fixed-Rate vs. Adjustable-Rate Mortgages

In New York, borrowers have the option to choose between fixed-rate and adjustable-rate mortgages. Here's a brief comparison of the two:

- Fixed-Rate Mortgages: With a fixed-rate mortgage, the interest rate remains the same throughout the life of the loan. This provides stability and predictability in monthly payments, making it easier to budget for homeowners.

- Adjustable-Rate Mortgages: Adjustable-rate mortgages, on the other hand, have interest rates that can fluctuate after an initial fixed period. While initial rates may be lower, there is a risk of higher payments in the future depending on market conditions.

Impact of Mortgage Rates on Home Buying Decision

Mortgage rates play a significant role in determining the overall cost of homeownership. Here are a few ways in which mortgage rates can impact your home buying decision:

- Lower Rates = Lower Monthly Payments: Lower mortgage rates can result in lower monthly mortgage payments, making homeownership more affordable.

- Higher Rates = Higher Total Interest: Higher mortgage rates can lead to higher total interest paid over the life of the loan, increasing the overall cost of the home.

- Affordability and Loan Approval: Mortgage rates can also affect the amount you can borrow and your qualification for a loan. Lower rates may make it easier to qualify for a larger loan amount.

Financial Preparation for Buying a House

When preparing to buy a house, it is essential to have your finances in order. This includes improving your credit score, understanding the debt-to-income ratio, and saving for a down payment and closing costs.

Improving Your Credit Score

Before applying for a mortgage, it's crucial to work on improving your credit score

- Pay your bills on time

- Keep your credit card balances low

- Avoid opening new lines of credit

- Check your credit report for errors and dispute inaccuracies

Debt-to-Income Ratio and Mortgage Approval

The debt-to-income ratio is a crucial factor that lenders consider when approving a mortgage. This ratio measures your monthly debt payments against your gross monthly income. Lenders prefer a lower debt-to-income ratio as it indicates a lower risk for default.

To calculate your debt-to-income ratio, use the following formula:

Debt-to-Income Ratio = Total Monthly Debt Payments / Gross Monthly Income

Saving for a Down Payment and Closing Costs

Saving for a down payment and closing costs is a significant part of the home buying process. Here are some tips to help you save for these expenses:

- Set a savings goal and create a budget

- Automate your savings by setting up regular transfers to a separate account

- Look for down payment assistance programs or grants

- Reduce unnecessary expenses to increase your savings rate

Working with Lenders and Real Estate Agents

When buying a house, working with experienced professionals like mortgage lenders and real estate agents can make the process smoother and more efficient. Let's delve into the roles of these professionals and how they can benefit you in your home buying journey.

Role of a Mortgage Lender

A mortgage lender plays a crucial role in the home buying process by providing you with the funds needed to purchase a property. They assess your financial situation, credit history, and overall eligibility to determine the amount you can borrow and at what interest rate.

Mortgage lenders guide you through different loan options and help you secure the best mortgage for your specific needs.

Benefits of Working with a Real Estate Agent

Real estate agents are invaluable resources when buying a house. They have extensive knowledge of the local market, access to new listings, and negotiation skills to help you secure the best deal. Real estate agents act as your advocates throughout the home buying process, from finding suitable properties to closing the deal.

Their expertise can save you time, money, and stress during this significant financial transaction.

Tips on Choosing the Right Lender and Real Estate Agent

- Do your research: Take the time to research different mortgage lenders and real estate agents in your area. Look for professionals with a solid reputation, experience, and positive reviews from past clients.

- Ask for recommendations: Seek recommendations from friends, family, or colleagues who have recently bought a house. Personal referrals can help you find trustworthy professionals who have a proven track record.

- Interview multiple candidates: Schedule meetings with several mortgage lenders and real estate agents to discuss your needs and assess their expertise. Choose professionals who listen to your concerns, communicate effectively, and demonstrate a genuine interest in helping you achieve your home buying goals.

- Compare rates and fees: When selecting a mortgage lender, compare interest rates, loan terms, and closing costs to ensure you're getting the most competitive offer. Similarly, discuss commission rates and services provided by different real estate agents to find the best fit for your budget and preferences.

Summary

In conclusion, navigating the intricacies of buying a house requires careful planning and understanding of the mortgage pre-approval checklist and current rates in New York. With the right knowledge and preparation, you can make informed decisions that will lead you to your dream home.

FAQ Overview

What is the importance of getting pre-approved before house hunting?

Getting pre-approved helps you understand your budget, gives you a competitive edge, and shows sellers you are a serious buyer.

What is the difference between fixed-rate and adjustable-rate mortgages?

A fixed-rate mortgage has a constant interest rate throughout the loan term, while an adjustable-rate mortgage has a rate that can change periodically.

How can mortgage rates impact my home buying decision?

Higher rates can increase your monthly payments and overall loan cost, affecting the affordability of your home purchase.

What tips can help in choosing the right lender and real estate agent?

Research their experience, communication style, and client reviews to ensure they align with your needs and goals.